LIC IPO

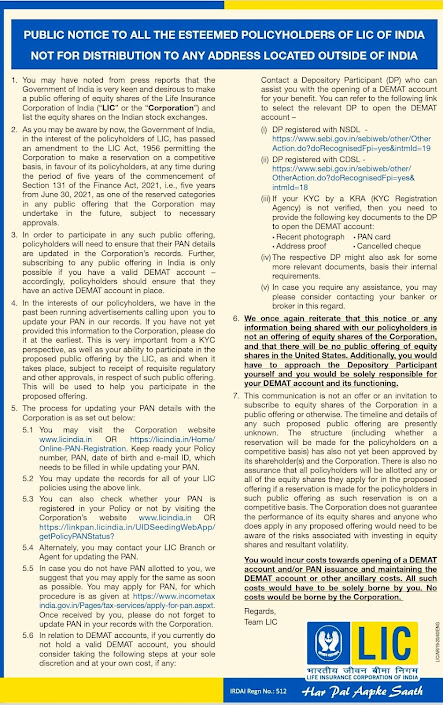

Individual, resident Indian policyholders with one or more LIC policies as on the date of DRHP and bid/offer opening date will be eligible to apply under this reserved portion.

The maximum bid per policyholder is capped at Rs 2 lakh. Policyholders who fail to update their PAN details by February 28, 2022 will not be eligible for this quota.

Only Policy holders who update their PAN No by Feb 28,2022 can apply under policy holders quota.

Up to 10% of the LIC IPO issue size would be reserved for policyholders.

How to apply for LIC IPO for a LICPolicy Holder

https://eterm.licindia.in/eServices/ipo_cell_notice

FAQ:

What is the LIC policyholders category? Will LIC policyholders get any benefit if they apply?

"Policyholder" is a new category introduced for the LIC IPO, this category will have up to 10% of the issue reserved for the customers who hold policies of LIC. To be eligible for making an application under the policyholder’s category;

- Your PAN has to be updated in the LIC records.

- The PAN used for LIC policies has to be the same as that registered with your Demat account.

How can I check if my PAN is already linked with my LIC Policy?

To check whether your PAN is already linked to your LIC policy:- Visit https://linkpan.licindia.in/UIDSeedingWebApp/getPolicyPANStatus

- Enter your Policy number, Date of Birth, PAN, and captcha in the respective fields and press submit to see your LIC policy and PAN link status.

How do I link my PAN with my LIC policy?

To update your PAN with your LIC policy:- Visit https://linkpan.licindia.in/UIDSeedingWebApp/

- To complete the process. You will need your PAN, along with the list of policies you hold. Click on “Proceed” at the bottom of the page.

- On the next page; Enter your Date of Birth, as per PAN, Gender, Email ID, PAN, Full name as per PAN, Mobile number, Policy Number (In case you hold multiple policies, click on “Add Policy” and proceed to enter another policy number)

- Click on the deceleration checkbox

- Enter the captcha.

- Click on the “Get OTP” option.

- Once you receive OTP on your registered mobile number, enter the OTP and click on “Submit”.

👉 Update your Contact Details (Online):

https://customer.onlinelic.in/LICEPS/portlets/visitor/updateContact/UpdateContactController.jpf

👉 Update your Contact Details (Offline):

How to Open Demat Account

India will see the highest new Demat account openings ahead of LIC IPO. There are many Brokers, both Online & Offline available in the market. Below is the illustration on how to Open Demat Account in Zerodha: https://zerodha.com/open-account?c=NF0389

👉 Charges Calculator: https://zerodha.com/brokerage-calculator#tab-equities

CHARGES

Account Opening Fee (Pay through Debit Card, Net Banking or Wallet)

Equity - Rs.200

MCX - Rs.100

Intra day charges - 0.03%

No other charges

To Open the account Fill the following details from the above link

👉Mobile No

👉Name

👉Email I'd

👉PAN No

👉Date of Birth

👉Father Name

👉Mother Name

👉Marital Status

👉Occupation

👉Bank details

👉Aadhaar No (Through DIGILOCKER )

👉Webcam Verification ( A Four Digit Code will be given. Write on a Paper and appear before the webcam)

UPLOAD

👉Cancelled Cheque Leaf (Optional)

👉Signature

👉PAN Card Copy

THAT'S IT.

You will receive your Login Credentials in your mail I'd within 24 hours.

In case of Doubts watch this video: https://www.youtube.com/watch?v=dcOIc8YZ9pc&t=18s

Disclaimer: This article is for the purpose of information and shall not be treated as solicitation in any manner and for any other purpose whatsoever. It shall not be used as legal opinion and not to be used for rendering any professional advice. This article is written on the basis of author’s personal experience and provision applicable as on date of writing of this article. Adequate attention has been given to avoid any clerical/arithmetical error, however; if it still persists kindly intimate us to avoid such error for the benefits of others readers.

Comments

Post a Comment